Rare Earth Element Value Chain Optimization Tool (REV-C)

Decision Support Systems Tools

Model Description

The model’s primary purpose is to evaluate how large‑scale deployment of the aluminum‑cerium (Al‑Ce) alloy influences the global REE market, specifically the price and volume dynamics of cerium when supplied as carbonate, oxide, or metal. By linking alloy demand to the three cerium commodity streams, the model quantifies the market‑wide repercussions of shifting demand, identifies which input form offers the most economical pathway, and assesses the ability of each market segment to absorb price shocks. The resulting insights help determine the most resilient cerium feedstock choice for future Al‑Ce production and illustrate how increased cerium utilization can alleviate the historic oversupply of light REEs.

Prerequisites

To replicate the analysis, users must have access to Stella Architect (or its equivalent iThink Stella) version 2.0 or later installed on a Windows‑based workstation (Windows 10/11 recommended) or a macOS system running the Windows‑compatible version via virtualization. The software requires a minimum of 8 GB RAM, a dual‑core processor, and 2 GB of free disk space for the project files and output data. A valid commercial license or an academic research license is needed, as the model employs built‑in system‑dynamics libraries (stock‑and‑flow, lookup tables, and optimization tools) that are not available in the free trial edition.

Methodology

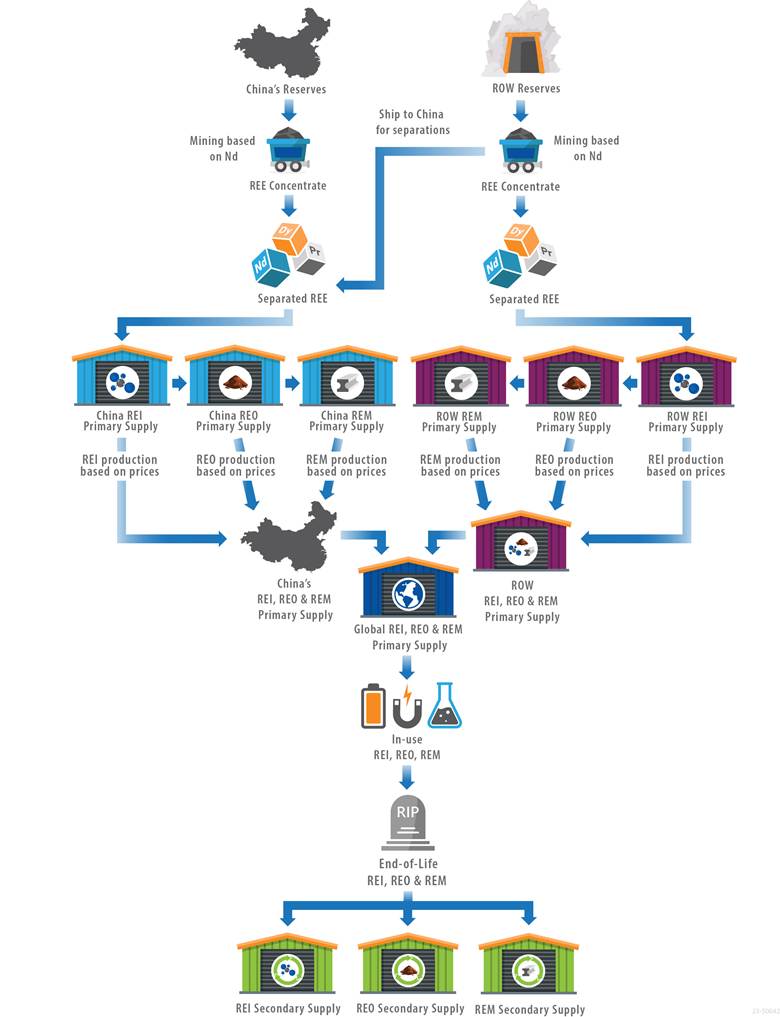

A comprehensive system‑dynamics model was constructed in Stella to capture the inter‑relationships among rare‑earth‑element (REE) demand, primary and secondary production, and price formation across three material forms (intermediates, oxides, and metals). Demand for each REE application was derived from Roskill forecasts and expert‑derived allocation factors, then disaggregated into the three forms using assumed distribution ratios. Primary production was driven by neodymium‑price‑dependent mining capacity utilization, differentiated between China and the rest of the world, and expressed via supply‑curve functions calibrated to historical Argus price data. A secondary‑production module tracked in‑use stocks, end‑of‑life collection, and recycling with specified lifetimes and efficiencies, feeding recycled supply back into the market. Prices were generated by applying constant demand‑elasticities (‑0.5 for light REOs, ‑0.3 for heavy REOs) to the supply‑demand ratio for each commodity form. An Al‑Ce alloy demand module imposed low‑ and high‑deployment S‑shaped growth scenarios (maximum 0.9 Mt and 4.5 Mt by 2050, respectively) beginning in 2025, converting alloy demand into cerium feedstock requirements (0.123 kg Ce kg⁻¹ Al‑Ce) and feeding these back into the REE demand modules. The model was run from 2005 to 2050, validated through extreme‑condition tests, dimensional consistency checks, reference‑mode comparisons, and Pearson‑correlation analysis against historical price series.

Funding Source

The research was funded by the U.S. Department of Energy’s Critical Materials Innovation Hub, administered through the Office of Energy Efficiency and Renewable Energy’s Advanced Materials and Manufacturing Technologies program. Execution of the work at Idaho National Laboratory was supported under DOE Contract DE‑AC07‑05ID14517. The United States Government retains a non‑exclusive, paid‑up, irrevocable worldwide license to reproduce or distribute the manuscript for governmental purposes. No additional external funding or conflicts of interest were reported.

This computer software was prepared by Battelle Energy Alliance, LLC, hereinafter the Contractor, under Contract No. AC07-05ID14517 with the United States (U. S.) Department of Energy (DOE). The Government is granted for itself and others acting on its behalf a nonexclusive, paid-up, irrevocable worldwide license in this data to reproduce, prepare derivative works, and perform publicly and display publicly, by or on behalf of the Government. There is a provision for the possible extension of the term of this license. Subsequent to that period or any extension granted, the Government is granted for itself and others acting on its behalf a nonexclusive, paid-up, irrevocable worldwide license in this data to reproduce, prepare derivative works, distribute copies to the public, perform publicly and display publicly, and to permit others to do so. The specific term of the license can be identified by inquiry made to Contractor or DOE. Neither the United States nor the United States Department of Energy, nor contractor makes any warranty, express or implied, or assumes any liability or responsibility for the use, accuracy, completeness, or usefulness or any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights.

Contact Information

Michael Severson